Trust Foundations: Dependable Solutions for Your Construction

Trust Foundations: Dependable Solutions for Your Construction

Blog Article

Securing Your Assets: Trust Fund Foundation Competence at Your Fingertips

In today's complex monetary landscape, making sure the safety and security and development of your possessions is paramount. Depend on foundations function as a cornerstone for guarding your wealth and heritage, offering an organized method to property security. Expertise in this realm can supply vital guidance on navigating lawful complexities, making best use of tax obligation performances, and creating a durable economic plan tailored to your one-of-a-kind needs. By touching right into this specialized knowledge, individuals can not just safeguard their possessions properly but also lay a solid structure for long-term wealth preservation. As we explore the intricacies of depend on foundation experience, a world of possibilities unfolds for strengthening your economic future.

Relevance of Trust Fund Structures

Trust structures play an important role in developing integrity and fostering solid connections in various specialist setups. Count on structures serve as the keystone for honest decision-making and transparent interaction within organizations.

Benefits of Professional Support

Structure on the structure of depend on in specialist partnerships, looking for professional support uses invaluable benefits for individuals and organizations alike. Expert advice gives a wide range of expertise and experience that can aid browse complicated monetary, legal, or strategic difficulties effortlessly. By leveraging the competence of experts in different fields, people and companies can make enlightened decisions that align with their objectives and desires.

One substantial benefit of expert guidance is the capacity to gain access to specialized understanding that may not be conveniently available otherwise. Specialists can use insights and perspectives that can lead to cutting-edge remedies and chances for growth. In addition, working with experts can aid reduce risks and unpredictabilities by offering a clear roadmap for success.

Furthermore, expert advice can save time and sources by enhancing processes and preventing costly errors. trust foundations. Professionals can supply customized advice tailored to details demands, guaranteeing that every choice is knowledgeable and critical. In general, the advantages of expert support are multifaceted, making it a useful property in protecting and making the most of properties for the long-term

Ensuring Financial Safety And Security

In the world of monetary planning, safeguarding a stable and thriving future hinges on critical decision-making and sensible financial investment choices. Making sure economic safety and security includes a diverse strategy that incorporates various aspects of wealth management. One vital element is producing a varied financial investment profile customized to specific threat resistance and economic objectives. By spreading out investments across different asset classes, such as stocks, bonds, realty, and assets, the threat of substantial economic loss can be minimized.

Additionally, keeping a reserve is necessary to protect against unanticipated costs or income disturbances. Professionals recommend reserving three to 6 months' well worth of living expenses in a fluid, quickly accessible account. This fund works as a monetary safeguard, offering satisfaction during unstable times.

Consistently Click This Link examining and adjusting economic plans in action to changing conditions is likewise extremely important. Life events, market variations, and legislative modifications can impact monetary security, highlighting the relevance of continuous analysis and adaptation in the search of long-term monetary security - trust foundations. By executing these approaches thoughtfully Learn More Here and constantly, individuals can fortify their economic ground and work in the direction of an extra protected future

Securing Your Assets Efficiently

With a strong structure in area for economic safety and security with diversity and emergency fund maintenance, the next vital step is protecting your assets efficiently. One effective strategy is property appropriation, which entails spreading your financial investments across different asset classes to reduce threat.

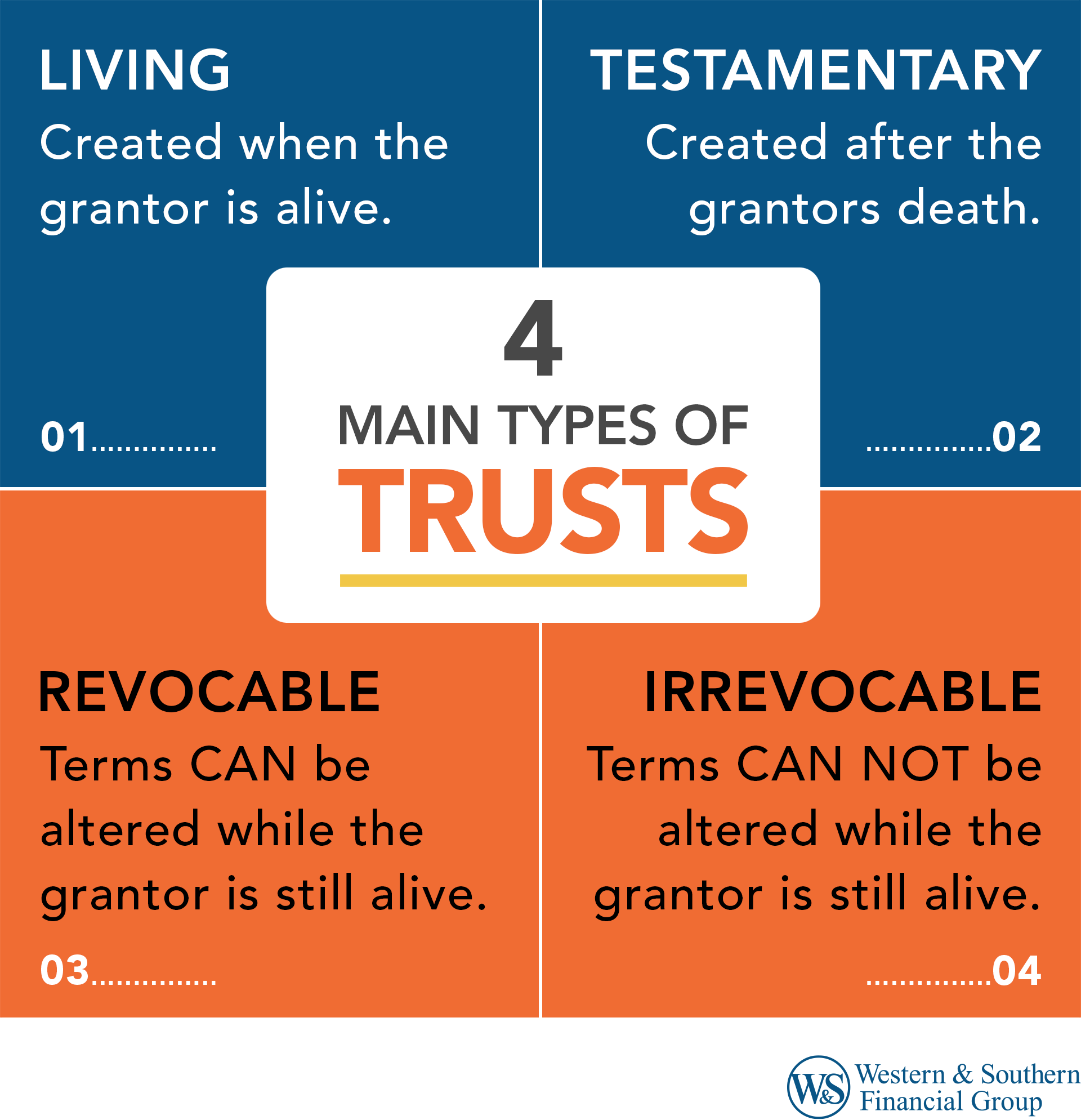

Additionally, developing a count on can offer a safe way to shield your possessions for future generations. Trusts can assist you control exactly how your assets are dispersed, minimize estate tax obligations, and protect your riches from creditors. By carrying out these strategies and looking for specialist guidance, you can guard your possessions efficiently and protect your economic future.

Long-Term Asset Defense

Long-term asset protection involves implementing procedures to secure your possessions from different dangers such as economic recessions, suits, or unexpected life events. One crucial facet of lasting possession security is establishing a trust, which can offer substantial benefits in securing your properties from lenders and legal disputes.

Furthermore, diversifying your investment portfolio is one more essential method for long-term property defense. By taking an aggressive strategy to lasting asset defense, you can safeguard your riches and give monetary protection for yourself and future generations.

Final Thought

In verdict, trust fund structures play a crucial role in protecting assets and guaranteeing monetary safety and security. Professional guidance in establishing and managing trust structures is essential for long-term property defense.

Report this page